Strategic Investment Portofolios

Fiduciary commitment + Fixed fees = Better Performance.

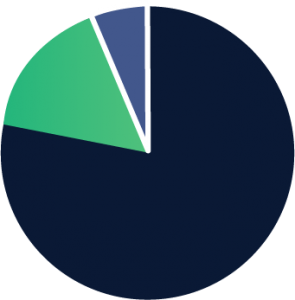

Income

Conservative

Moderate

Aggressive

IncomeEquity

-

Fixed Income

-

Developed Equity

-

EM-Equity

-

Non-Traditional

Discretionary Portfolios:

Avila Advisors LLC opens, design and manage Investment Portfolios; based on recommendations and tools provided by some of the largest world-wide asset managers.

We focus our strategies in sector investing, according to your needs and with tax efficiency, using a diversified mix of financial assets aimed to reduce volatility in returns.

We work and get paid by you, not by another bank or financial institution, current laws limit us on receiving fees from third-party providers for offering you products; which makes our advice fiduciary to your needs, becoming your truly allied.

Non-Discretionary Portfolios:

If you are an experienced investor, we will give you we the most advance trading tools, market information, support and tactical strategies; walking with you in the process of modeling your investment portfolio, using a diversified mix of:

which creates stability and income.

that can offer growth and appreciation.

with thousands of mutual funds to invest in.

The modern and cost-efficient way to invest in sectors.

A way to diversificate returns and reduce risk from traditional stock and bond portfolios.

Steps to enjoy the advantages of a

Strategic Investment Portfolio.

Meet with us in person or online.

In a free non-obligation session, we will explain you in detail our services, walk through your objectives, experience and goals with your portfolio. You will receive a business proposal.

Choose your preferred Financial Institution to work with

Setup your Online services and login details.

Your money will be held at your preferred Custodian.

For details, please see www.sipc.org.

For your investment account opening purposes

We will need:

Driver license or Passport, Tax ID or SSN

and a utility bill.

Transfer money to your Investment account and choose your investment strategy

Once the money is available, we will manage the investments according to your preferred strategy. No long-term commitments needed.

We are limited by law on providing strategic advice and trades on your portfolio, we cannot withdraw money from your account.